This article was written by Nermin Hajdarbegovic and originally appeared on Toptal.com.

Smartphones have turned into the Swiss Army knife of the tech world, enabling millions of people to take care of countless computing needs on the go, and mobile payments are another frontier. The hardware is ready and software is not far behind, so what’s the hold up?

Well, in order to make mobile payments a reality, tech companies have to jump through a number of technological and regulatory hoops, plus, they have to wait for various other industries to get in line, as well. Apple, Google and Samsung are heavyweights and trendsetters, but that does not mean they are able to force banks, credit card companies, and merchants to play their game.

Today, we will be taking a look at the future of mobile payments and emerging opportunities for developers. Needless to say, with each new opportunity, developers will have to face new challenges. However, since we are talking about money, I don’t think anyone expects a shortage of software developers eager to learn a few new tricks and get into this space.

Apple Pay vs. Android Pay vs. Samsung Pay

Let’s start with a quick overview of the most promising mobile payments platforms out there.

Apple Pay hardly needs an introduction at this point, but I should note that it’s still the new kid on the block. Apple limited the initial rollout to North America, so it will be a while before users around the globe get a chance to pay for their coffee with their iPhone.

Samsung fired back with the announcement of Samsung Pay during the Galaxy S6 launch event. Like Apple’s service, Samsung’s payment solution is limited to its own hardware, but it has a few neat tricks up its sleeve. My favourite is Magnetic Secure Transmission (MST), which was integrated following the acquisition of LoopPay. This clever technology allows compatible Samsung phones to emit a magnetic field that simulates the swiping of a “magstrip” card, fooling the card reader into thinking a card was swiped. In theory, it should enable the use of Samsung Pay on legacy point of sale (POS) devices, which were designed and deployed long before mobile payments became a reality.

Android Pay is launching in North America as we speak, and being vendor-agnostic, it should work on a majority of Android devices. Users will just need a phone running Android 4.4.x KitKat or later, along with Near Field Communication (NFC) support. Google claims NFC is already present in about 70 percent of potentially compatible phones. NFC integration took a while, bearing in mind that Google first deployed the technology into the good old Nexus S, which launched in late 2011. The latest versions of Android, iOS, and Windows support biometric security as well, which should help.

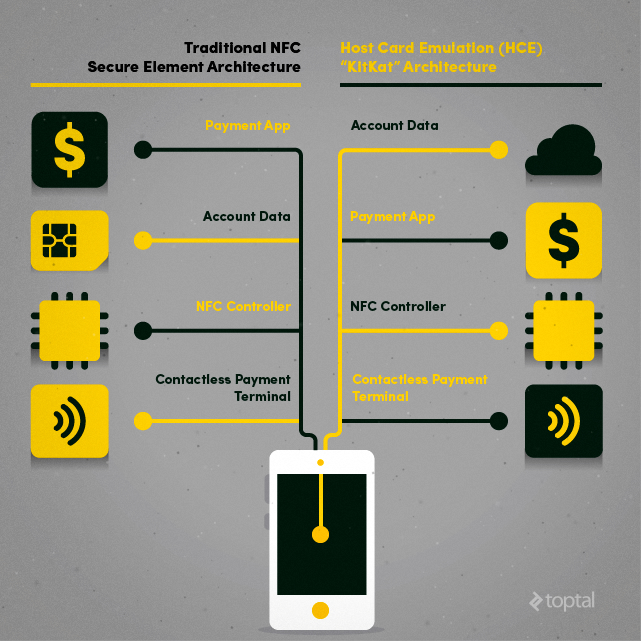

In many respects, Apple Pay, Android Pay, and Samsung Pay are similar; the underlying idea is the same, the implementation is similar, and the goal is to enable virtually any consumer to use these services, which means they have to be fool proof or fail. They rely on tokenization to eliminate sensitive data transfers. If you are familiar with Google Wallet, you probably know that it does not rely on tokenization. However, Android Pay still shares some solutions used in Google Wallet. For example, both rely on Host Card Emulation (HCE), while Apple Pay employs a Secure Element (SE) to protect sensitive information. Both HCE and SE have certain advantages, and you can check out this quick comparison for more info.

Looking at the feature set and market support, each platform – Android Pay, Apple Pay and Samsung Pay – has something going for it. Apple Pay relies on a large and loyal consumer base running homogenous hardware. Samsung’s trump card is MST. Android Pay will be available on more devices than Apple Pay and Samsung Pay combined, but, for the moment, it will have to deal with heterogeneous hardware. You can probably see what I am aiming at here: If we had one mobile payments standard that covered all of the above, we would probably see faster market adoption.

The Problem With Mobile Payments

So what are the big challenges for these systems? Security, privacy, and consumer trust, along with time-to-market and market adoption.

While consumers may get a new phone every two years or so, merchants don’t replace their POS infrastructure as often. This means they are stuck with the same hardware for years. Banks, credit card companies and payment rail operators need to force an upgrade. And this brings up another problem: If a merchant in Ottawa or Seattle gets a lot of consumer demand for NFC-enabled POS terminals, he or she will contact the credit card company. To stay competitive, merchants will need new hardware to keep up with demand. However, what happens in Lagos or Buenos Aires? Not much, because demand won’t pick up for a while, and the infrastructure won’t be ready for years.

In my opinion, the lack of a coherent mobile payments infrastructure strategy is the biggest problem facing the industry. It may take years for all the pieces of the puzzle to fall into place. As usual, developed markets will lead the way, while developing countries will be slow to catch up.

The fact of having three different, yet similar, platforms endorsed by three tech giants, is another problem. It will slow down adoption, and depending on how easy it is to migrate from one platform to another, it may lock in users who simply can’t be bothered to switch. Make no mistake, mobile payments services will be big money makers for those who end up controlling the market. Google Wallet transactions, reportedly, did not generate a profit, and Google was losing cash on each transaction. However, imagine a billion smartphone users paying for everything with their mobile phones, now imagine that you skim off just a couple of dollars off their transaction fees each year. That sounds like a nice little money maker, does it not? Analysts are still divided, but most are bullish on Apple Pay’s prospects. It’s safe to assume that rivals will not cede this potentially lucrative market to Apple, and I expect a number of players will emerge, especially from big, regional markets like China and India.

Mobile payments will be a hotly contested space, and strong competition could be a double-edged sword.

Security and regulatory concerns are another problem. Although a lot of time and effort will go into making these systems secure, sooner or later, cybercriminals will catch up and come up with inventive ways of bleeding reckless consumers dry. Yes, I said it, mobile payments will never be totally secure no matter what tech companies do. Sooner or later, someone will figure out a way of scamming people out of their money. However, looking at the broader picture, I don’t think this will be a huge concern. Credit card fraud is still widespread, and people still get mugged in dark alleys. Criminals will simply shift their focus.

Besides, if you ever find yourself $100 out of pocket over a mobile payments hack (or fraud), consider this: That’s still better than being robbed of $100 at knifepoint.

Regulation will also have to catch up with mobile payments, and this may take a while. Since we are not a law firm, I won’t get into this particular problem. Let’s just let lawmakers and lawyers figure it out. That usually works, sort of.

The Mobile Payments Revolution Is Just Getting Started

So what does the advent of services like Samsung Pay, Apple Pay and Android Pay mean for developers? It is still too early to make a definitive call, because the services really aren’t out yet.

Technically, Apple Pay is alive and kicking, but it’s limited to certain markets. However, the list of Apple Pay partners is growing, albeit international adoption is likely to remain slow. A couple of weeks ago, Samsung announced that the Samsung Pay beta is live in the US, but users can try it out only if they have a “special invite.” Android Pay has not launched yet, but recent leaks suggest it should launch in the second half of September 2015.

Of course, Apple Pay, Samsung Pay and Android Pay aren’t the only services out there. We are seeing new ones developed by established players, such as MasterCard and PayPal, but we are also seeing ancillary services created by startups like Square.

It looks like it will take a few quarters, or even a couple of years, for all three services to mature and gain mainstream adoption. However, I believe it’s time for developers to start considering the implications of the upcoming mobile payments revolution.

These will be the key drivers pushing mobile payments adoption:

-Convenience

-Once consumers try contactless payments, they don’t go back

-Speed will create new use cases

-Reduced exposure to risk

-Mass availability

Convenience is the driving force behind mobile payments. Why mess around with cards if you can pay for stuff with your mobile phone? The fact that other cards, such as loyalty bonus cards issued by merchants, can be integrated into digital wallets, is another possibility. Who doesn’t want to carry around fewer cards in their wallet?

Although contactless payments are a relatively new concept, it appears that users who get hooked never look back. In a recent interview with Fortune, MasterCard Chief Emerging Payments officer Ed McLaughlin said people who tap to pay more than two or three times “don’t go back to their prior behaviour,” due to the speed and convenience of contactless payments.

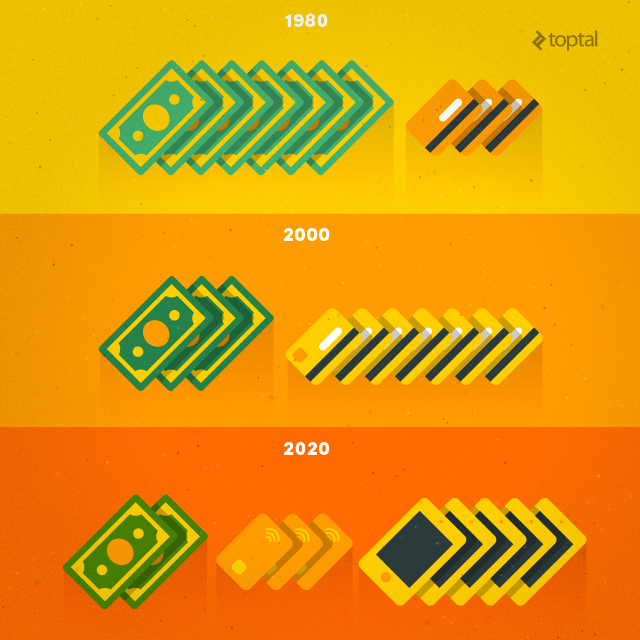

However, this does not mean that mobile payments will merely replace existing card transactions. The newfound convenience is likely to create more use cases for digital payments because they could supplant cash transactions in many situations.

This brings up another point that doesn’t have much to do with technology. If a mobile phone with loads of cards is lost, all the user needs to do to render them useless is to destroy the security tokens. There is no need to replace the cards, which is a hassle. Use of tokenized mobile payments solutions will also reduce the need to protect data on the retailer side, thus reducing operating costs and reputational risk in case of data breach (insert Ashley Madison reference here).

That’s not all. Less cash in physical wallets and cash registers also means less crime. What’s the point of stealing a wallet if all the thief will find in it is some change, a driver’s license and a gym membership card? Why would armed robbers bother holding up a gas station or convenience store if there is simply next to no cash to steal? Of course, there is always the risk that someone could somehow breach all the security layers and steal your money digitally. However, this would really raise the bar for the average criminal.

Mass availability will be tricky. It might not be a fast process, especially in emerging markets, but once the infrastructure is in place, we will see rapid growth. Deloitte predicts that 2015 will be a watershed moment for the industry.

In a research note, the financial giant said:

“Deloitte expects that 2015 will be an inflection point for the usage of mobile phones for NFC-enabled in-store payment, as it will be the first year in which the multiple prerequisites for mainstream adoption – satisfying financial institutions, merchants, consumers, technology vendors and carriers – are sufficiently addressed.”

Mobile Payments For Developers

But what do Apple Pay, Android Pay, Samsung Pay and other mobile payments platforms mean for the average mobile developer?

There are a number of ways mobile payments will become a part of our everyday lives:

-Integration into existing products and services

-Further evolution of “click-and-mortar” business models

-Creation of alternative services built on top of mobile payments platforms

-Development of entirely new use cases for mobile payments

The first point is the most obvious one, and I suspect it will have the biggest impact on software development. I won’t be discussing the technical side of integrating mobile payments into existing applications, or new ones; the process is well-documented, so you can head over the Google and check out the official Android API tutorial. Google also offers information on user flows, process flow diagrams, a quick integration overview, UI branding requirements, and best practices. Apple also has a number of resources covering Apple Pay, including the official Apple Pay Programming Guide, app review guidelines, identity guidelines, iOS UI guidelines and more.

The question is, how many businesses will decide to integrate mobile payments into their existing mobile apps over the next few years? Since industry leaders will ensure the process is straightforward, I don’t think there will be many technical challenges to overcome. Get the APIs, follow the guides, and that’s it; it’s a bit like integrating any other payment option.

Integration will cover retail, e-tail, and, in some cases, in-app payments. The hope is that seamless, one-tap payments will help increase conversion rates, at least that’s what tech companies are saying to attract businesses.

However, unlike m-commerce, which already relies on a host of digital payment options, traditional retail will stand to gain more from new mobile payments platforms. We already use PayPal to buy stuff online, but what about the sandwich shop down the street, furniture shops, gas stations and so on?

The trend of blurring the lines between traditional brick-and-mortar retail and online commerce is sometimes referred to as “click-and-mortar.” It’s a broad concept, dealing with goods bought online and picked up in retail locations, use of price comparison engines in physical stores (to make sure you are getting a good deal), or plain browsing through malls, to see how a product actually looks and feels before you go home and make an online purchase. Sure, all of us buy books, gadgets and hardware components online, but what about shoes, pants, or office chairs? That’s stuff most people prefer to try beforehand. A purchase would usually involve a cash or card transaction, but with mobile payments, it becomes another fully digital transaction.

So far, we’ve dealt with a few ways mobile payments will change how existing businesses operate, but what about entirely new use cases? What about new services resulting from the integration of mobile payments platforms in our smartphones and wearables? This will likely be the next niche to emerge: A space for innovation and the creation of a new generation of killer apps, piggybacking the new mobile payments infrastructure. I think it’s still too early to say what sort of concepts could be built on top of services like Apple Pay and Android Pay. Besides, if I had any good ideas, I would be busy recruiting talent to make such a service a reality, and I definitely wouldn’t be writing about it in a blog post.

Who Will Win The Mobile Payments Race?

Everyone.

They all want a slice of the pie, but the pie is huge and there is enough to go around. Apple Pay, Android Pay, Samsung Pay and other competing platforms should have no trouble gaining market share and turning a profit for their parent companies (unlike Google Wallet).

Ultimately, this is good news for everyone, from regular consumers who want a safer and faster way of spending money, to tech and financial giants that will reap the benefits and make a handsome profit.

The software industry will need to cater to all needs and address all mobile payment platforms that gain a sufficient market share in a given region. For example, if you want to develop an app for North American consumers, you should have no trouble integrating all the popular platforms. However, if you want to target China, you will probably have to tap local alternatives as well (let’s say solutions offered by major Chinese mobile brands and retail giants like Xiaomi, Huawei, Meizu and Alibaba’s Alipay).

I doubt anyone, including Google and Apple, could monopolise this niche; there is simply too much at stake, so entrepreneurs and governments will rush to promote region-specific mobile payments solutions. Why should Apple shareholders make money on transactions executed in China, why should Brazilians pay a fraction of each transaction to Google? That’s something politicians and regulators will need to deal with, but it might have an impact on market adoption and fragmentation.

In any case, I think the takeaway should be clear: It’s time to start looking into mobile payments and getting ready to integrate them. While progress is slow, market research suggests we will see a lot of growth moving forward, which means developers will have no choice but to hop on board. Keep track of new developments, check out the official documentation and get ready to integrate mobile payments; it’s as simple as that.

Comments are closed.